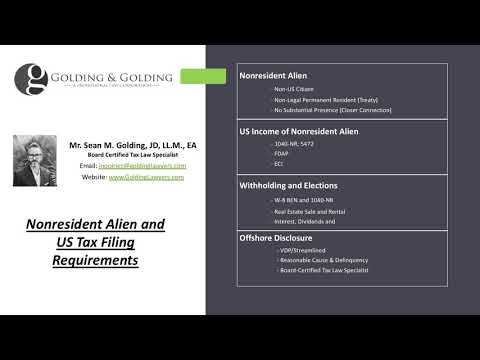

Good afternoon, this is Sean Golden with Golden Golden. Here to discuss the basics of the non-resident alien U.S. income tax and filing requirements. No matter how many times we say "non-resident alien," it just sounds harsh, right? It just means someone who's not a U.S. person. A U.S. person is a legal permanent resident, U.S. citizen, or foreign national who meets the substantial presence test and doesn't qualify for one of the exceptions of 8840 cluster connection exception or exclusions under 8843. So when a person is a U.S. person, then they're taxed on their worldwide income. The way the U.S. tax works is absurd. So, you have Michelle. Michelle is a U.S. citizen that lives in the UK and earns all of her money from Taiwan. She hasn't set foot in the United States in a few years. It doesn't matter. She has informally expatriated. So, from a U.S. tax perspective, the U.S. can still tax her on her worldwide income. Sure, she may qualify for the foreign income exclusion, she may qualify for the housing exclusion, she may have some foreign tax credits to offset the income. But the baseline perspective is that she's a U.S. citizen, so she's taxed on her worldwide income. When you're a non-resident alien, it's entirely different. The U.S. can't just tax an individual who has no U.S. sourced income, who is not a U.S. person. There's no right to do that unless they have U.S. sourced income. That's what we're going to discuss a little bit here today. So, let's say a non-resident alien they have no U.S. ties, but they have investments in the U.S. This is considered U.S. sourced income, and the IRS sourcing rules are super important. We have a whole another section of our website dedicated to that because when...

Award-winning PDF software

Irs Releases Publication 519 (2019), Us Tax Guide For Aliens: What You Should Know

This publication answers a lot of the questions most people have about the tax status of 2023 Publication 519 (2023), U.S. Tax Guide for Aliens 2025 Publication 519 (2025), U.S. Tax Guide for Aliens — IRS Publication 519 (2025) is available. This publication answers a lot of the questions most people have about the tax status of 2026 Publication 519 (2026), U.S. Tax Guide for Aliens — IRS 2028 Publication 519 (2028), U.S. Tax Guide for Aliens IRS Publication 519 (2028), U.S. Tax Guide for Aliens — Treasury This publication is from the Treasury Department. There will be a lot of information available on this publication about taxation for residents, nonresidents, and residents. 2029 Publication 519 (2029), U.S. Tax Guide for Aliens — Treasury IRS Publication 519 (2029), U.S. Tax Guide for Aliens This publication is from the Treasury Department. IRS Publication 519 (2029) will explain the differences between certain categories of tax returns. It provides advice on how to file your tax return and what you need to know. 2040 Publication 519 (2040), U.S. Tax Guide for Aliens IRS Publication 519 (2040), U.S. Tax Guide for Aliens — Treasury This publication is from the Treasury Department. IRS Publication 519 (2040) will explain the special rules for a specific 2041 Taxation of Resident Aliens — IRS Publication 519 (2041), Taxation of Resident Aliens This publication is from the Treasury Department. This publication will help you determine the tax and social security tax benefits you may be eligible for. The publication also includes information on the financial impact each of 2041–2016 Publication 519–2016, U.S. Tax Guide for Aliens IRS Publication 519–2016 is the U.S. citizen tax guide for aliens in 2016. 2051–2056 Publication 519–2016, U.S. Tax Guide for Aliens The U.S. federal tax system applies to all residents of the United States. U.S. tax laws apply to all aliens who are attempting to become resident aliens. U.S.

Online alternatives enable you to to organize your document management and improve the productivity of your workflow. Follow the fast handbook as a way to total IRS Releases Publication 519 (2019), US Tax Guide for Aliens, refrain from faults and furnish it inside of a well timed manner:

How to accomplish a IRS Releases Publication 519 (2019), US Tax Guide for Aliens online:

- On the website when using the form, simply click Commence Now and move towards editor.

- Use the clues to fill out the appropriate fields.

- Include your individual information and call knowledge.

- Make guaranteed that you just enter suitable information and facts and numbers in acceptable fields.

- Carefully verify the articles from the type likewise as grammar and spelling.

- Refer to help you part when you have any issues or tackle our Guidance crew.

- Put an digital signature in your IRS Releases Publication 519 (2019), US Tax Guide for Aliens with all the help of Indicator Instrument.

- Once the form is accomplished, push Carried out.

- Distribute the prepared variety by way of e mail or fax, print it out or help save with your device.

PDF editor permits you to definitely make modifications with your IRS Releases Publication 519 (2019), US Tax Guide for Aliens from any web connected machine, personalize it according to your preferences, indication it electronically and distribute in different means.

Video instructions and help with filling out and completing Irs Releases Publication 519 (2025), Us Tax Guide For Aliens