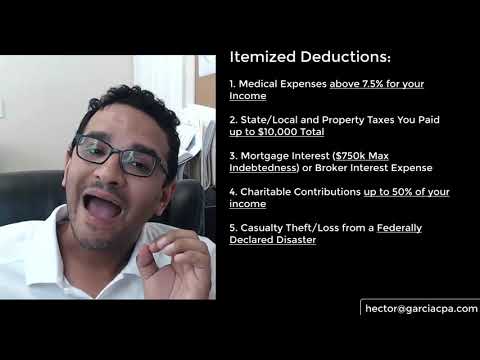

Hi folks, I'm Hector Garcia, a CPA and professional tax preparer. I want to talk to you about the differences between itemizing deductions and taking the standard deduction. For some context, in the year 2018, after the tax law changed, the standard deduction went up to $12,000 for single taxpayers and $24,000 for married filing jointly. That is an increase of almost double. As you can see, in 2017, the single standard deduction was just over $6,000 for singles and just over $12,000 for married individuals. Now, for head of household, which means you're single and have at least one dependent, the deduction increased to $18,000. So, what we're trying to achieve with this video is to determine whether or not it is worth it for us to itemize the deductions. This can be done using Schedule A from your personal tax return. Alternatively, should we take the standard deduction? In other words, we're trying to understand whether adding up all the numbers from the itemized deductions becomes a bigger number than the standard deduction. The standard deduction has two goals. One is to simplify tax preparation, where you don't have to explain anything, just take the standard deduction and that's it. The other goal is to help those who don't have itemized deductions. Now, let's go over the typical things to consider when itemizing deductions. First, do you have a significant amount of medical and dental expenses? This would include payments to doctors or medicine, not your insurance premiums. However, there is a 7.5% floor or minimum. You take your total income or adjusted gross income (AGI) and multiply it by 7.5%. For example, if your salary is $100,000, 7.5% would be $7,500. Only expenses above $7,500 would count. This rule applies for those with high out-of-pocket medical expenses. Second, did you pay any...

Award-winning PDF software

Standard deduction worksheet for dependents 2024-2025 PDF Form: What You Should Know

Get an amended return so that you can take the personal adjustment. 2 Personal Filing Status Tax Deduction Worksheets. This worksheet will help you determine if filing as single, married filing jointly, separated, or surviving with dependents 2 Standard Adjustment, Form 2023. Get an amended return so that you can take the standard adjustment. 2024 Filing Status Tax Deduction Worksheet. Worksheet provides guidance to determine the FEDERAL STANDARD income tax deduction for tax year 2024, and filing status 2024 Income Tax Returns. Get Form 2055 to file your tax returns for your taxable year. 2 The IRS provides a list of filing and handling dates for the two calendar years.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Publication 501, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Publication 501 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Publication 501 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Publication 501 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Standard deduction worksheet for dependents 2024-2025 PDF