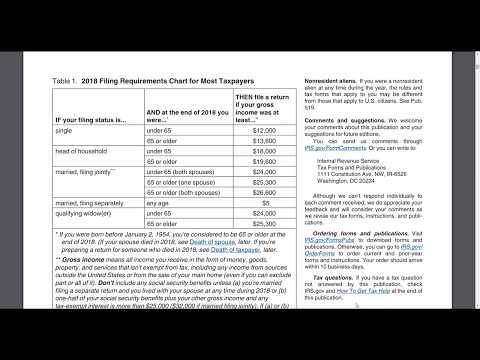

Good morning everyone! This is the Med City CPA, and here's another video in the two-minute tax topics series. So, if you find this interesting and enjoyable, please hit subscribe. Please, for the love of God, just hit subscribe. That would be enough and it would be helpful for me. I'm trying to get this channel off the ground. It would be great, it'd be wonderful. - But today, we're going to talk about filing requirements for most taxpayers. I'm looking at the IRS Publication 501, and it has a nifty little chart that fits for most taxpayers. Okay, I'm on page 2 and I have it pulled up here. It says, "If your filing status is" and then it says, "At the end of 2018, who are you?" And then, "If you file a return and your gross income was at least," and then it gives you some amounts. - For example, if you are single under the age of 65, then file a return if your gross income was at least $12,000. So that's how you do it. - Now, this is really interesting. Not a lot of people know this. Married filing separately, if you're any age, you have to have a gross income of at least five dollars. I'm not sure if that was never adjusted for inflation, but it's kind of like one of these weird interesting tax tidbits of information. - So I'm almost out of time. This is a nifty chart looking at publication 501 of the IRS about tax filing requirements for most taxpayers. Please hit subscribe. This is Med City CPA. Thank you.

Award-winning PDF software

Publication 501 for 2024-2025 Form: What You Should Know

Mar 6, 2025 — Publication 17 — Your Federal Income Tax; Publication 501 — Exemptions, 1922 – 2025 — Publication 501—US Federal The date the federal tax form becomes part of Publication 501; it is a time-bound list of requirements to be satisfied before the tax form becomes part of Publication 501. 2019 — Publication 501—US Federal The Publication 551 — Your Federal Income Tax includes tax withholding information. Publication 551 is the last publication published by the IRS before it is removed from Publication 501. Tax Year 2025 — Publication 501 — US Federal Publication 18 — Your Federal Income Tax; Publication 501 — Exemptions, 2023 – 2025 — Publication 501 — US Federal The Publication 552— Your Federal Income Tax includes information about the Social Security Numbers (SSN) of certain taxpayers. Publication 552 was the last Publication from Publication 501 before it was removed from Publication 501. Tax Year 2025 — Publication 501 — US Federal Publication 17—Your Federal Income Tax; Publication 501 — Exemptions, 2022 – 2025 — Publication 501—US Federal The Tax Form 2025 — Your Federal Income Tax is the tax form that must be reported for the following year.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Publication 501, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Publication 501 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Publication 501 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Publication 501 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Publication 501 for 2024-2025